While the world’s economic trends continue to point towards a looming recession, many metrics used to determine such can provide valuable insight into how to plan for the future.

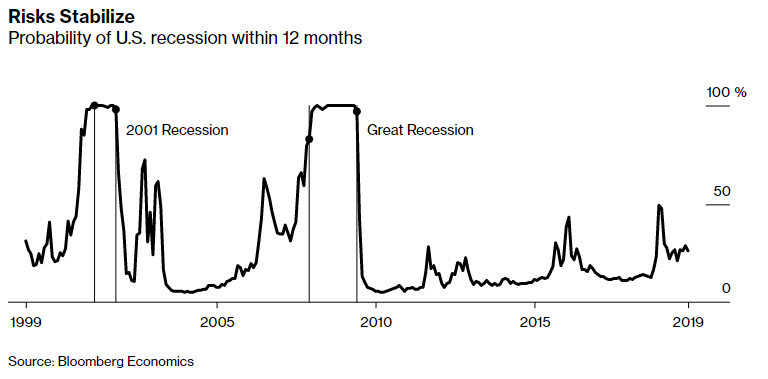

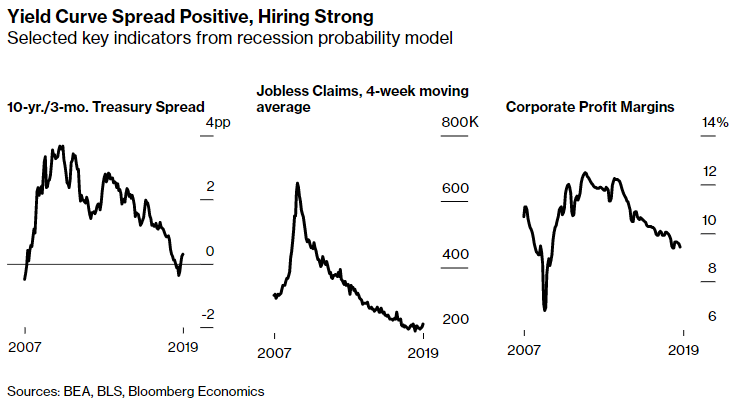

The projected chances of a U.S. recession are down to 26% from 29% in the previous month and are likely to continue to decrease as the country experiences the lowest jobless rate in a half century, thanks to soaring stock prices, a steeper yield curve and a resilient labor market. Taking the U.S. Treasury yield curve and higher stock prices into consideration shows some stabilization of the Conference Board’s Leading Economic Index (LEI), with the six-month annualized LEI only down 0.4%, even when unchanged since November. Currently, risks of recession are mainly centered on corporations’ lack of spending, as well as corporate profit margins.

Percentages are calculated according to the recession probability model developed by Bloomberg economists Eliza Winger, Yelena Shulyatyeva, Andrew Husby and Carl Riccaodnna, taking in to account economic conditions, financial markets and gauges of underlying stress. While predicting the beginning of a recession is challenging, several indicators at varying time periods can help determine the chances.

As recessions are often accompanied by a rapid increase in the unemployment rate, one of the initial predictive indicators at the zero-month mark is the weekly filings for unemployment benefits. Observed at the three-month marks, six-month marks, and more, filings for unemployment benefits are indicative of key factors in determining a recession. Observations over a shorter period, such as over the three-month mark, are more likely to be indicate changes in spending habits as evidenced by financial-market variables. As the range for data becomes larger, more inclusive and holistic data becomes more reliable, i.e. using the LEI as a metric when observing from the six-month mark. Long-term ranges of data, such as those over a year or more, will begin to show possible disproportionate readings of data, such as higher reports of consumer spending at the cost of corporate interest relative to profit.

With the Federal Reserve reducing the target range for its benchmark borrowing rate by three times in 2019, there is now less flexibility to protect against any potential risks to the longest ongoing expansion of the economy. These reductions may have helped consumers spend and invest more in the last year, but has created clear vulnerabilities for the future.

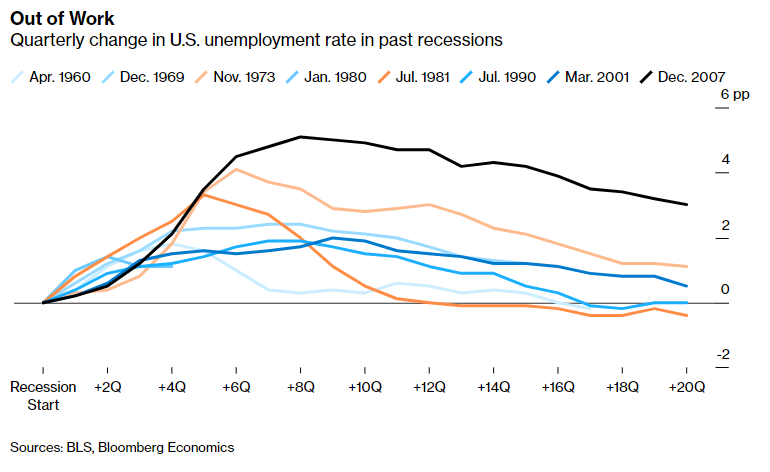

Rather than observing two consecutive quarters of negative growth as the usual indicator for a recession, the National Bureau of Economic Research defines a recession as a “significant decline in economic activity spread across the economy, lasting more than a few months.” No two recessions are created the same, as previous recessions have been shorter and shallower the latest was especially long and deep, with jobless rates differing greatly between each downturn depending on the extent and severity of the recession, peaking at 10% in 2009.

Predicting a recession is determined through a multitude of data points and trends, but will ultimately allow you to prepare your business for the worst. Knowing the strengths and the weaknesses of the current economy won’t only be a catalyst for your strategizing, but will also greatly increase your chances at coming out the other end with a head start.